If you’re pitching VCs with zero revenue, you’re not underfunded. You’re delusional.

Most founders don’t fail to raise capital because their idea is bad or their pitch needs work. They fail because they’re asking people who will never fund them at a stage where funding that type of business makes no structural sense. A pre-revenue founder pitching Series A investors is wasting time the same way a profitable $2M company applying for startup grants is wasting time.

The real question isn’t “what funding sources exist.” It’s “which sources will actually fund me at the stage I’m in — not the stage I wish I were in.”

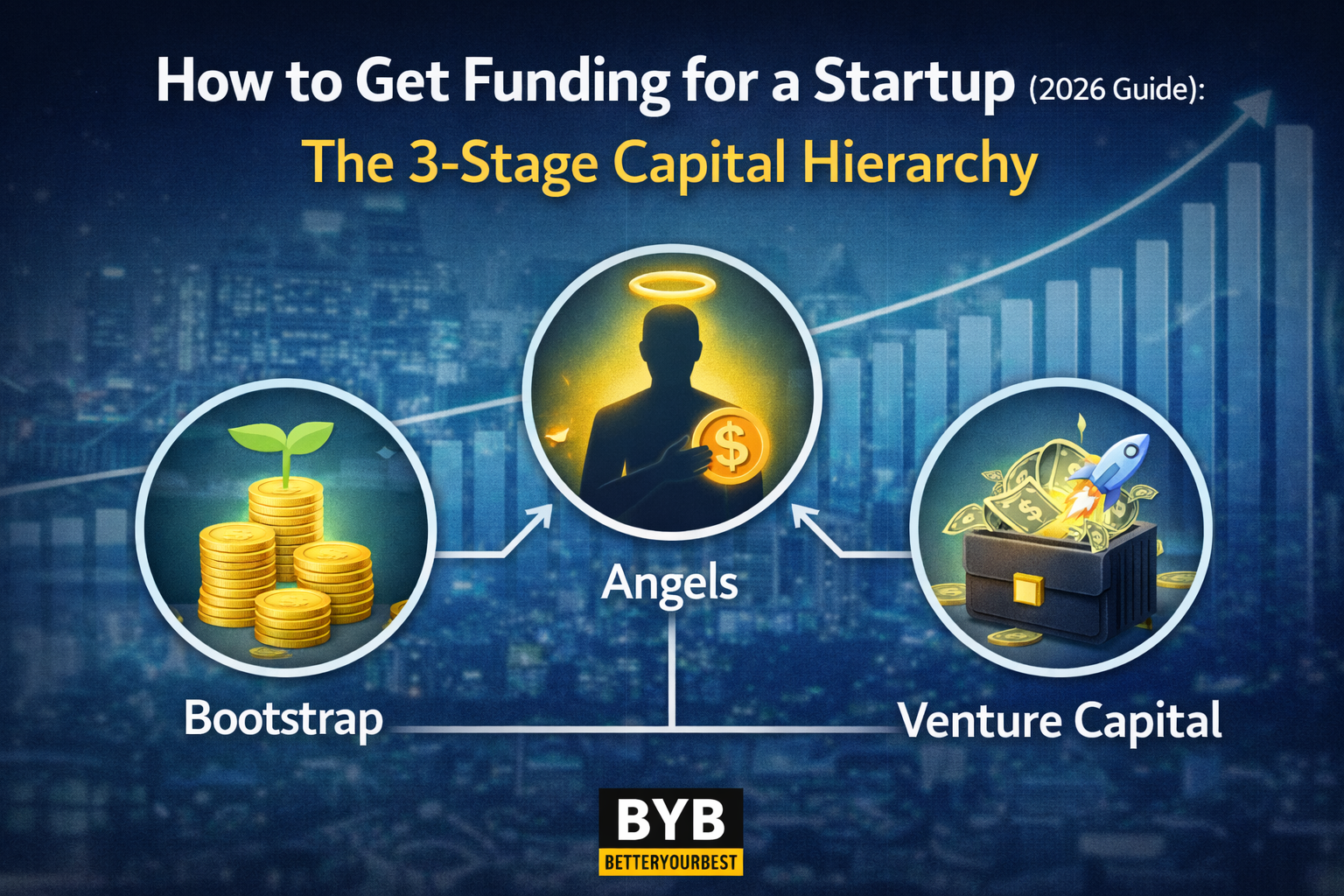

This is the funding hierarchy — the sequence that corresponds to proof, not ambition.

The 3-Stage Funding Hierarchy

Stage 1: Pre-Traction ($0–$50K)

- Available funding: Bootstrap, friends/family, pre-sales, grants

- What unlocks it: Proof someone will pay

Stage 2: Early Traction ($50K–$500K)

- Available funding: Angels, revenue-based financing, SBA microloans

- What unlocks it: Repeatable customer acquisition

Stage 3: Proven Model ($500K+)

- Available funding: VC, banks, strategic investment

- What unlocks it: Scalable unit economics

Funding sources aren’t interchangeable alternatives. They exist in a hierarchy determined by risk and proof. Your stage dictates which will fund you and which will reject you regardless of how good your story is.

Stage 1: Pre-Traction ($0–$50K) — Stop Pitching. Start Proving.

What this looks like:

- Fewer than 10 paying customers

- No consistent revenue

- Product may not be fully built

What’s available: Your own money. Income from a job. Friends and family (<$25K typically). Customer pre-sales. Grants if you qualify by demographics or industry.

What’s NOT available:

- Angels: They fund traction, not ideas. No customers = no proof.

- VCs: They commonly need revenue traction and a path to large exits. You don’t qualify.

- Banks: They lend against cash flow and collateral. You have neither.

The reality nobody says:

If you can’t fund the first $10K–$50K yourself or through customer revenue, that’s not a funding problem. It’s a signal the idea might not work. The best “funding” at this stage is the first dollar a customer pays you. That’s validation. Everything else is a hypothesis you’re afraid to test.

Founders who skip straight to raising external capital usually do so because they’re terrified to find out if anyone will actually pay. That fear is data. It’s telling you the market hasn’t confirmed this works yet.

For more on validating your business before raising capital, see questions you must answer before starting a business.

Move to Stage 2 when:

- 10–50 paying customers

- Unit economics work (revenue per customer > cost to acquire + serve)

- Repeatable acquisition channel (not random one-off sales)

Stage 2: Early Traction ($50K–$500K) — Now You Qualify

What this looks like:

- 10–100+ customers

- Consistent monthly revenue (even if small)

- Clear acquisition channel

- Product solves a real problem

- You need capital to scale what’s already working

What’s available:

Angel investors ($25K–$250K): Individuals betting on founder + early signal. They don’t need billion-dollar outcomes — $10M–$50M exits work. Find them: AngelList, local networks, LinkedIn, introductions from other founders.

Revenue-based financing ($50K–$500K): Borrow and repay as 3–8% of monthly revenue until you’ve repaid 1.5x–2x. No equity given up. Works if you have predictable revenue but can’t get bank loans yet. Providers: Clearco, Pipe, Capchase.

Grants: Non-dilutive but competitive. Federal (SBIR/STTR) favor tech. State programs support job creation. Expect 3–6 month processes.

SBA microloans: Up to $50K via community lenders. Created for women, minorities, veterans. Flexible eligibility.

What’s still not available:

- Traditional banks (need 2+ years profitable operations)

- Series A VCs (for most institutional rounds, expect at least $1M+ ARR and clear path to $100M revenue)

The decision:

- High-margin, capital-light (SaaS, consulting): Bootstrap longer or use revenue-based financing. Giving up 20% equity now costs millions later.

- Capital-intensive (hardware, biotech, enterprise): Angels or grants. You need runway before revenue compounds.

- Proven model, need speed: Revenue-based financing. Faster than equity, less dilution.

Move to Stage 3 when:

- $500K–$1M annual revenue

- Sustained growth (in many early-stage markets, around 20%+ monthly for 3+ months)

- Unit economics improve with scale

- Sales process repeatable (not founder-dependent)

Stage 3: Proven Model ($500K+) — Institutional Capital Unlocks

What this looks like:

- $500K–$5M+ annual revenue

- Product-market fit proven

- Repeatable sales

- Need capital to scale faster than revenue can fund organically

What’s available:

Venture capital (Series A: commonly $2M–$15M): VCs invest other people’s money. They need 10x+ returns to make fund economics work. This means:

- Only businesses with $100M+ revenue potential

- 15–25% equity for $2M–$15M

- Board seats and significant control

- Exit (acquisition or IPO) expected within 5–10 years

When VC makes sense: Winner-take-most markets where speed matters more than profitability. Deep tech, infrastructure, network effects. Markets large enough for $100M+ revenue.

When it doesn’t: Lifestyle businesses ($1M–$10M sustainable revenue). Niche or geographically limited markets. You want control and your own timeline.

The alternative: If you have strong revenue and margins, banks will lend now. A $500K line at 8% costs far less than 20% equity. Revenue-based financing at this stage can provide $1M+ with no dilution.

Many founders chase VC because it feels like validation. It’s not. It’s a financial instrument for a narrow category of high-risk, high-growth businesses. Most successful businesses never raise VC and don’t need to.

For more on why scaling prematurely destroys businesses, see why small businesses fail.

Why Most Founders Can’t Raise (And What to Actually Do)

Founders fail to raise capital because they’re asking before they have proof the business works.

The four types of proof investors want:

- Proof of demand: Customers paying, not hypothetical interest

- Proof of economics: Customer lifetime value > acquisition cost, and math improves with scale

- Proof of repeatability: Defined channel that gets customers predictably

- Proof of scalability: Margins improve as you grow

If you can’t raise: Go back one stage. Build the proof you’re missing. If angels won’t fund you, get 10 more customers and try in 90 days. If banks won’t lend, make revenue consistent. Investors rejecting you isn’t personal. It’s data about proof you haven’t built.

For more on building proof through financial discipline, see small business financial management.

How to Actually Approach Investors (Warm Beats Cold 10:1)

Cold outreach: 100 emails often yield 2–5 responses, maybe 1 meeting. Conversion under 3% in most cases.

Warm introductions: Introduction from someone the investor trusts can get you a meeting 40–60% of the time in many markets.

How to get warm intros:

- Other founders who’ve raised from that investor

- Industry operators who know them personally

- Advisors with investor relationships

- Accelerators (Y Combinator, Techstars, 500 Startups)

If you have no intros: Build in public. Share traction, metrics, learnings on Twitter/X, LinkedIn, industry communities. Investors notice founders who demonstrate progress publicly. Slower than warm intros, but it works.

Common Mistakes That Burn Months

Raising too early: You pitch before you have proof. Result: rejections, wasted time, burned relationships. When you return with traction, investors remember you as “not ready last time.”

Fix: Build 6 more months. Get 20 more customers. Then raise.

Raising too much: You ask for $2M when you need $500K. Signals lack of discipline.

Fix: Ask for 18–24 months operating capital based on actual runway calculation.

Wrong funding type: VC for a lifestyle business. Bootstrap for capital-intensive hardware. Both fail differently.

Fix: Match funding to economics. High-margin = bootstrap or revenue-based. Capital-intensive = equity.

No use of funds: Investor asks “what will you do with this money?” You say “grow the business.”

Fix: “$200K for 2 engineers to build X. $150K for ads to acquire 500 customers in Q2. $100K runway buffer.”

The Funding Sources Outside the Hierarchy

Crowdfunding (Kickstarter, Indiegogo): Consumer products with visual appeal. Works when you have a prototype and can demonstrate demand. Requires $5K–$15K for video, ads, campaign management. Average raise: $20K–$50K.

Business credit cards: Short-term cash flow timing (invoiced client, payment takes 60 days). Dangerous when you carry balances — 18–24% APR compounds faster than most businesses grow. If you’re funding your startup with credit cards, you don’t have a startup. You have a debt experiment.

Friends and family: $10K–$50K for MVP or market test. Treat it like a real investment — write terms, specify equity or repayment, make risk clear. If they can’t afford to lose it, don’t take it.

The Psychological Truth Founders Avoid

The real reason you can’t raise isn’t your pitch. It’s that you haven’t built what investors fund.

Some founders chase funding because they’re afraid to test the market. Raising capital feels like progress. Building and hearing “no” from customers feels like failure. So they spend 6 months pitching investors instead of getting 50 customers.

If you need investor validation before customer validation, you’re building for ego, not market. Investors are not therapists. They are capital allocators evaluating whether your business has already proven it can extract money from a market. If it hasn’t, no pitch will change that.

If investors won’t fund you, maybe the market already gave you its answer. You’re just asking investors to validate an idea customers already rejected.

The ego trap: VC funding feels like status. Banks feel boring. Bootstrapping feels small. So founders optimize for how the funding looks, not what the business actually needs.

The market doesn’t care how you feel about your funding source. It cares whether your business works. Proof is the only thing that unlocks capital. Everything else is storytelling to people who’ve heard better stories from businesses with more proof.

Stop pitching. Start proving. Investors fund traction, not potential.

Leave a Reply