1. THE OPENING: A FAILURE OF DIAGNOSIS

The entire marketing industry is currently looking at the Dr Pepper Romeo TikTok moment and drawing the wrong conclusions.

They see a funny video. They see “User Generated Content (UGC) beating expensive agencies.” They see a lucky break for a random creator. This is a superficial analysis. It is the equivalent of looking at an iceberg and discussing the texture of the snow on top while ignoring the massive structural mass beneath the water.

If you think this case study is about “Lo-Fi video” or “Viral Marketing,” you are missing the most important economic shift in modern business.

The Real Story: This event proves that the Locus of Value Creation has permanently shifted outside the corporation. For 100 years, corporations created value (ideas, slogans, jingles) and pushed them to the market. Today, the market creates value (ideas, slogans, jingles), and the corporation’s only job is to identify, validate, and acquire it.

Dr Pepper did not “market” anything. They performed a Cultural Acquisition. They realized that a young creator in a dark room had generated a higher-performing cultural prototype than their internal teams could predict.

This article is not about how to go viral. It is about accepting that you no longer own your brand—you merely manage the license to monetize what the community creates with it.

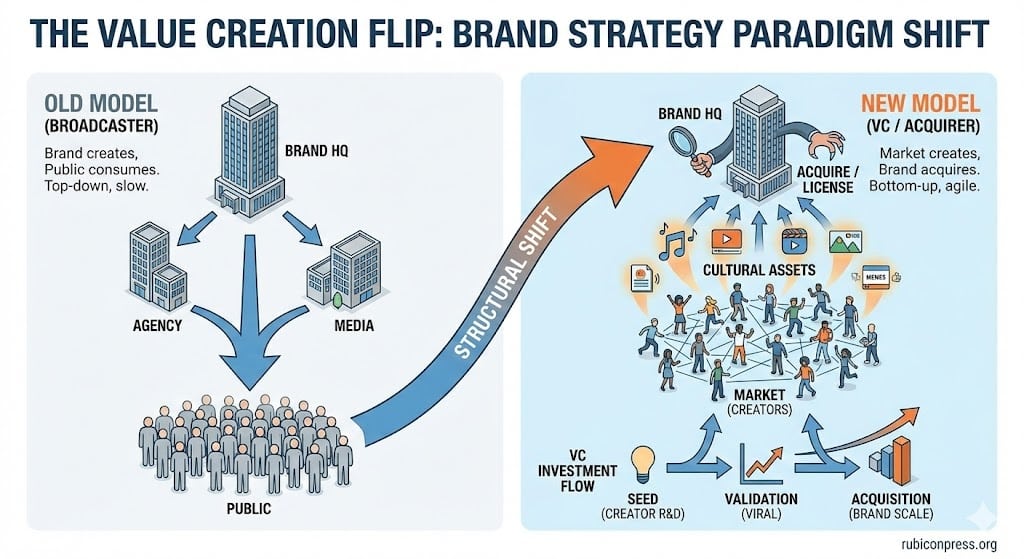

2. THE SHIFT: FROM BROADCASTER TO VENTURE CAPITALIST

To understand why the agency model is failing, we must look at the Supply Chain of Creativity.

The Old Model (The Broadcaster):

- Brand hires Agency.

- Agency invents “The Idea.”

- Brand pays Media to broadcast “The Idea.”

- Public consumes “The Idea.”

- Flaw: This assumes the smartest people in the room are on your payroll. They are not.

The New Model (The Venture Capitalist):

- The Market (Creators) invents 1,000 “Ideas” per day using your product.

- The Algorithm (TikTok/Reels) acts as the “Market Validator.” It kills the bad ideas and elevates the good ones.

- The Brand watches the data.

- The Brand “Invests” (Acquires/Boosts) the winning Idea.

The Romeo Case Analysis: Romeo was not an influencer. She was an independent R&D lab. She developed a prototype (the jingle). She released it to the market (TikTok). The market validated it (widespread organic traction and high-velocity remixes). Dr Pepper simply came in at the Series A Funding Stage. They didn’t take the risk of creation; they bought the certainty of traction.

The Strategic Insight: Your marketing department is no longer a “Creative Studio.” It is an “Asset Management Firm.” Your job is not to write the script. Your job is to find the person who already wrote the script better than you ever could, and cut them a check.

3. THE MONETIZATION MOMENT: WHAT THE DR PEPPER ROMEO TIKTOK CASE REVEALS ABOUT VALUE

The genius of this case lies in the alchemy of value. How does boredom translate into shareholder equity? We need to trace the conversion of Cultural Capital into Financial Capital.

Phase 1: Zero Intent (The Spark) Romeo posted out of boredom (“iseng”). There was no brief, no KPI, and no commercial ambition. This lack of intent is crucial—it is the source of the authenticity.

Phase 2: Algorithmic Amplification (The Validation) The algorithm detected high retention and engagement. It pushed the content to millions. The community validated the asset by remixing it. At this stage, the jingle became Cultural Capital. It had value, but it wasn’t monetized.

Phase 3: The Commercial Transaction (The Conversion) This is where Dr Pepper separates itself from the amateurs. They didn’t just repost the video for “clout.” They entered into a formal licensing agreement. The creator was formally compensated through licensing rights, converting spontaneous attention into contracted revenue. In a matter of days, a joke became an invoice. This validates the thesis: The market does the R&D, the brand provides the capital.

4. THE ASSET CLASS: CULTURE AS INTELLECTUAL PROPERTY

When Dr Pepper turned Romeo’s video into an ad, they weren’t just “being cool.” They were engaging in IP Arbitrage.

They acquired cultural IP at a post-validation valuation instead of funding speculative internal creation. Think about the cost of generating a cultural asset internally. To create a jingle that sticks in the heads of 20 million people usually costs millions in media spend and months of focus grouping. Romeo created a cultural asset with $0.

The Value Equation:

- Romeo (The Creator): Created the Value (The Hook).

- The Community (The Validator): Proved the Value (The Virality).

- Dr Pepper (The Monetizer): Captured the Value (The Brand Association).

Structural Redefinition: This forces a structural redefinition of the Creative Director’s role. In the past, the Creative Director was the “Maker.” In the current attention economy, the Creative Director must be the “Curator.” If you are arrogant enough to think you can manufacture culture in a boardroom, you will lose to the brand that is humble enough to simply harvest culture from the streets.

5. LUCK VS. STRUCTURAL READINESS (THE HIDDEN VARIABLE)

Let’s address the elephant in the room: Luck. Was Romeo lucky? Yes. Was Dr Pepper lucky? Yes. But “Luck” is a lazy word for “Probability.”

Thousands of creators make jingles. Most fail. Romeo hit the algorithm lottery. That is the variable you cannot control. However, what happens AFTER the luck is entirely strategic.

The Counter-Factual Scenario: Imagine this happened to a rigid, legacy brand.

- Legal team sees unauthorized use of logo.

- Brand guidelines team sees “bad lighting.”

- CMO says “This isn’t our tone.”

- Action: Silence. The spark dies.

The Dr Pepper Advantage: Dr Pepper’s victory was not creativity; it was Structural Readiness. They had a system that allowed them to:

- Detect the signal early (Social Listening).

- Assess the risk (Low).

- Approve the partnership (Agility).

- Execute the contract (Legal flexibility).

Luck provided the spark. Organizational Structure provided the gasoline. If your company takes three weeks to approve a tweet, you are structurally designed to waste luck – the same structural decay that turns scaling into paralysis, as explored in The Suicide of Success: How Scaling Turns Agility Into Concrete. You are building a firewall against serendipity.

6. THE FOUNDER’S NEW MANDATE: NEGOTIATING THE BRAND

If you are a Founder or CEO, this changes your job description.

You likely believe that “Brand Building” means defining your colors, your voice, and your values. That is Defensive Branding. It protects the basement, but it doesn’t build the skyscraper.

Offensive Branding is a negotiation – the same strategic pivot seen when Airbnb turned a trust crisis into its strongest advantage. You put a product into the world. The world tells you what it is.

- You think your product is for “productivity.”

- The market decides it’s for “anxiety relief.”

- The Old Founder: “No, you’re using it wrong.”

- The New Founder: “You are right. I will pivot my messaging to match your usage.”

Clarifying Ownership: You do not own your brand. You own the trademark (Legal Reality). The Brand (Cultural Reality) is a shared hallucination held by the market. Your job is to steer the hallucination, not to contradict it. Dr Pepper didn’t ask for a funk jingle. But the market negotiated: “This is what Dr Pepper sounds like now.” Dr Pepper signed the deal.

7. THE ECONOMICS OF “LO-FI” (SIGNAL OF ORIGIN)

Why do we keep talking about “Lo-Fi” (Low Fidelity)? It is not an aesthetic choice; it is a Signal of Origin that serves as an economic filter.

In a digital environment saturated with AI-generated content and corporate polish, “Bad Lighting” has become a primary proxy for “Human Truth.”

- Hi-Fi (Studio Quality): Signals a script, a budget, and an agenda. It triggers the consumer’s “Ad Blocker.”

- Lo-Fi (Phone Quality): Signals spontaneity. It bypasses the skepticism filter because it implies the creator had no commercial incentive to lie.

Pre-Validated Creative: When you license a creator’s asset, you are effectively buying certainty. Traditional advertising is Speculative (High Uncertainty). Creator acquisition offers Lower Uncertainty. You are allocating capital to validated performance rather than speculative production.

8. THE TRAP OF “FAKING IT” (CORPORATE ISENG)

A warning to the opportunists: Now that you understand this, you will be tempted to “fake” a Romeo moment. You will hire a creator to “act bored” and make a jingle. You will tell your team to “make it look viral.”

This will fail. It will fail because you are trying to Manufacture what can only be Harvested. Romeo worked because of Intent. Her intent was boredom. Your intent is sales. Consumers can smell the KPI on your breath.

The Protocol for Brands: Stop trying to be Romeo. Be the Stage for Romeo. Create challenges, release assets, open your IP, and invite the chaos. But do not try to script the chaos. The moment you script it, it becomes a commercial. And nobody shares a commercial.

9. FINAL COMMAND: THE ASSET MANAGER MINDSET

The Romeo incident is not a cute story about a lucky creator. It is a brutal economic lesson for the C-Suite.

It proves that the most efficient way to build a brand is not to shout louder, but to listen better. It proves that Value Creation has decentralized. It proves that the brands that win in the next decade will not be the ones with the best agencies, but the ones with the best social listening infrastructure and the lowest Ego.

The Choice:

- The Controller: Continue to tightly police your brand, sue creators for misuse, and force-feed the market your “approved” messaging. (You will become irrelevant).

- The Acquirer: Accept that the market is smarter than you. Build the infrastructure to spot value, license value, and amplify value. (You will dominate).

Dr Pepper didn’t create the wave. They just had the surfboard ready. Build yours.

Stop trying to create culture. Start acquiring it.

EVIDENCE & MARKET PATTERNS

- The Creator Economy Valuation: The Creator Economy is estimated to be worth $250 Billion (Goldman Sachs, 2023), signaling that independent value creation now rivals traditional media conglomerates. The Dr Pepper Romeo TikTok case is the cleanest illustration of this macro-economic shift—where brands act as buyers, not makers.

- Community-Led Growth: Data from McKinsey suggests that companies with “Community-Led Growth” strategies see a significant reduction in Customer Acquisition Cost (CAC) across multiple B2C sectors compared to sales-led models. Romeo is effectively a zero-CAC asset acquisition, validating this data point in real-time.

- Responsiveness as a Moat: Harvard Business Review analysis on “Real-Time Marketing” consistently indicates that response speed is a primary differentiator in campaign success. Brands that can contractually and creatively react to a trend within the first 48 hours capture the majority of the cultural value.

Leave a Reply