THE OPENING: THE “INSTANT CEO” MYTH

The internet has popularized a dangerous narrative: “Entrepreneurship Through Acquisition” (ETA).

The pitch is seductive. Why start a business from scratch—where failure rates are notoriously high in the early years—when you can buy a profitable one using “Other People’s Money” (SBA loans) and retire into a life of passive income? Influencers sell courses telling you to buy a laundromat, a pest control company, or a SaaS platform and simply “manage the manager.”

This is a dangerous oversimplification.

Buying a small business (under $5M revenue) is not like buying a stock. When you buy a stock, you buy a passive claim on future cash flows. When you buy a small business, you are often buying:

- A chaotic operational mess held together by duct tape.

- A customer list that belongs to the previous owner personally, not the company.

- A hidden legal liability waiting to explode.

- A 60-hour-per-week job disguised as an asset.

If you enter the deal flow with the mindset of a “shopper,” you will be slaughtered. You must enter with the mindset of a Forensic Investigator.

Most first-time buyers don’t fail because of math—they fail because of ego. The moment you believe you are smarter than the system you are buying, you fall into what we previously dissected as the CEO Psychology Trap.

Most sellers are not evil, but they are tired. They want out. And they are incentivized to present the best possible version of a dying machine. Your job is to find the cracks before the wire transfer clears.

This is the BYB Acquisition Protocol—the 6 non-negotiable truths you must internalize before you sign a Letter of Intent (LOI). Whether you are a first-time buyer looking for an SBA loan or a strategic investor looking for an add-on, the traps remain the same.

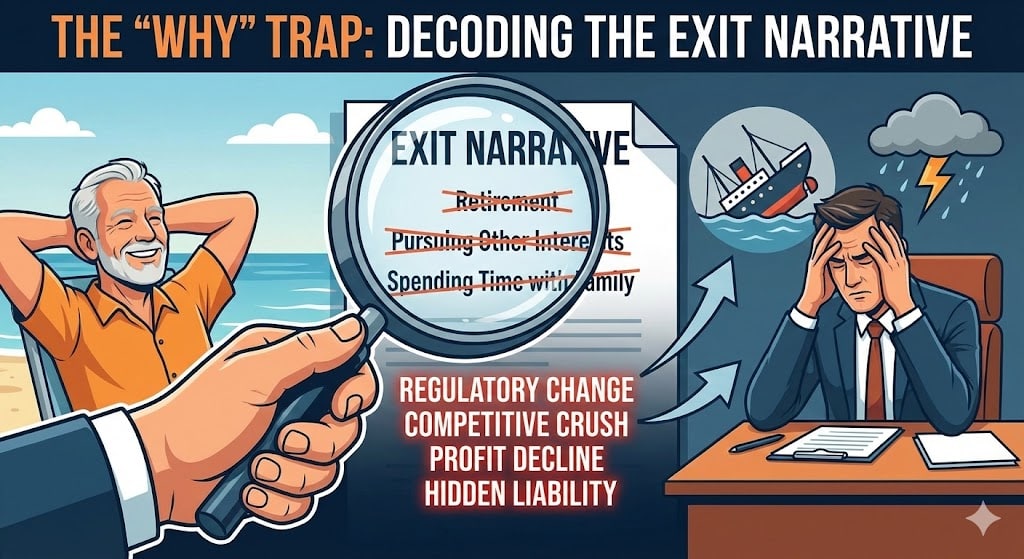

1. THE “WHY” TRAP: DECODING THE EXIT NARRATIVE

Every listing on BizBuySell or Flippa has the same reason for selling: “Owner retiring to spend time with grandkids.” “Owner pursuing other business interests.”

The Forensic Reality: In many cases, this is a polite fiction. Smart people do not sell gold mines unless the mine is running dry, or there is an earthquake coming. If a business is truly printing cash on autopilot with low effort, the owner would simply hire a General Manager at market rate and keep the remaining profit as passive income. The fact that they are selling often indicates a problem they don’t want to solve.

The “Falling Knife” Scenario: Often, the owner is selling because they see a specific threat on the horizon that you do not yet understand.

- Regulatory Change: Is a new local ordinance about to ban their primary signage or operational method?

- Technological Obsolescence: Is AI about to wipe out their service model (e.g., a translation agency or basic copywriting firm)?

- Competitive Crush: Did a VC-backed competitor just enter the market with massive funding to burn on customer acquisition?

The Audit Protocol: You must interrogate the “Why” with data, not just conversation.

- The 36-Month Trend Analysis: Do not look at the last 12 months (LTM) of revenue alone. Look at the last 36 months. Is the growth flattening? If revenue is up but margins are down, the owner is likely “buying revenue” (spending heavily on ads) to pump the top line before a sale. Often what you are really buying is a company that has already lost its strategic agility—what we’ve called the silent collapse where scaling turns adaptability into rigidity in The Suicide of Success.

- The “Keep It” Test: Ask the owner directly: “If this business is so perfect, why don’t you just hire a CEO and keep the cash flow?” Watch their body language. If they stutter or give a vague answer about “wanting a clean break,” they are likely hiding the operational burden.

The Lesson: You are not buying the past performance; you are buying the future risk. If the seller is running toward the exit, make sure the building isn’t on fire.

2. THE SDE ILLUSION: FINANCIAL GYMNASTICS

In Small Business M&A, we rarely use EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for deals under $5M. We use SDE (Seller Discretionary Earnings).

SDE is supposed to represent the total financial benefit to one full-time owner-operator.

- Formula: Net Profit + Owner Salary + Personal Expenses (Cars, Dinners) + One-time Expenses.

The Problem: SDE is one of the easiest metrics to manipulate in small business M&A. Brokers and sellers are incentivized to “add back” everything to inflate the SDE, because the business is sold as a multiple of SDE (e.g., 3x SDE).

- The Math: If they add back $50,000 of dubious expenses, at a 3x multiple, they just increased the purchase price by **$150,000.**

Common “Fake” Add-Backs to Reject:

- “One-Time” Marketing: The seller says, “We spent $20k on a rebrand, that’s a one-time cost.” No, it isn’t. Marketing is an ongoing cost of survival. Unless it was a literal one-off event like a launch party, do not accept it.

- Unpaid Family Labor: “My spouse does the bookkeeping, but we don’t pay them.” Warning. When you buy the business, the spouse leaves. You now have to hire a professional bookkeeper at market rates. This is a Negative Add-Back. You must subtract this cost from the SDE.

- Rent Adjustments: If the owner owns the building and pays themselves below-market rent, you are in for a shock. When you buy the business, the rent will triple to market rates. You must adjust the SDE down by the difference.

The Audit Protocol: You must “normalize” the P&L (Profit and Loss). Strip out every aggressive add-back.

- If they claim the trip to Hawaii was a “business conference,” delete it unless they can prove it generated revenue.

- If they claim the repair of the delivery truck was “one-time,” delete it. Trucks break every year. That is Maintenance CapEx.

The Lesson: The SDE on the brochure is a marketing number. The “Adjusted SDE” you calculate in Excel is the real number. Never pay a multiple on the brochure number; pay on the proven cash flow.

3. THE KEY MAN RISK (THE “BUS FACTOR”)

This is the number one deal-killer that beginners miss. Who is the business?

Is the business a system of transferable processes, or is the business just John (the owner)?

- Does John hold all the client relationships personally?

- Does John hold the technical knowledge (the “secret sauce”)?

- Does John fix the server when it crashes because no one else knows the password?

If the answer is “Yes,” the business is worth dramatically less unless structured correctly.

The Client Loyalty Trap: In B2B service businesses (agencies, consulting, construction), clients often buy the person, not the logo. If John sells the business to you, and 40% of the clients say, “I only worked with this company because I trusted John,” those clients will churn within 90 days of his departure. You bought a leaky bucket.

The “Bus Factor” Audit: Ask this question: “If the owner was hit by a bus and went into a coma for 3 months, what happens to revenue?”

- If revenue drops 10% → Buyable.

- If revenue drops 50% → Dangerous.

The Strategic Fix: If the Key Man Risk is high, you cannot pay all cash at closing. You must structure an Earn-Out.

- Deal Structure: “I will pay you 60% now. The remaining 40% is paid over 2 years, contingent on revenue staying above a certain threshold and key clients remaining.”

- This handcuffs the seller to the transition. If the clients leave, he loses money. This is the only way to insure against Key Man Risk.

4. CUSTOMER CONCENTRATION: THE WHALE PROBLEM

In the corporate world, having a “Whale” client (a massive account) is a badge of honor. In the acquisition world, having a Whale client is a fatal flaw.

The Rule of 30%: As a general heuristic, no single customer should account for more than 30% of total revenue. Ideally, the revenue should be diversified enough that a single client loss doesn’t threaten your ability to service debt.

The Scenario: You buy a niche manufacturing plant for $2M. It creates $500k in profit. But Client A (e.g., a large retail chain or government contract) provides 45% of the revenue. Six months after you buy it, the client changes its procurement officer. The new officer decides to switch vendors to save 2%.

- Result: Your revenue drops 45%. Your profit collapses (often to zero or negative because fixed costs like rent and salaries remain). You can no longer service your debt. You go bankrupt.

The Audit Protocol: Request the Customer Concentration Report (anonymized if necessary) immediately. Look at the distribution.

- If there is high concentration, the business is not an asset; it is a Sub-Contractor. You are essentially buying a contract that can be cancelled at any time.

The Valuation Adjustment: If you still want to buy it, the multiple must crash. As a rough market heuristic, a business with distributed revenue might sell for 3.5x SDE, whereas high concentration typically compresses multiples significantly (often down to 1.5x – 2.0x SDE) because the risk profile is exponential.

5. THE “ORGAN REJECTION” (CULTURE & EMPLOYEES)

You have analyzed the spreadsheets. The math works. But businesses are not math; they are sociology.

When a new owner takes over a small business, the immune system of the company often attacks the new organ. This is Organ Rejection.

The Employee Psychology: The existing employees have a “social contract” with the old owner. Maybe he let them leave early on Fridays. Maybe he didn’t track KPI metrics strictly. You enter the building. You are the “New Guy.” You want to “optimize.” You want to install CRM software. You want to track hours.

The Exodus: In the first 6 months of an acquisition, turnover often spikes if the transition is mishandled. If the staff you lose are the “Tribal Knowledge” holders (the ones who know how the old machine works), the business grinds to a halt.

The Hidden Liability: Look for “Ghost Employees”—people on the payroll who are friends/family of the owner and do nothing. Also, look for “Underpaid Key Players.”

- Example: The General Manager is paid significantly below market rate. He stays because he loves the old owner. When you buy it, he will demand a market adjustment or leave.

- Impact: Your SDE just dropped by the difference in salary.

The Transition Strategy: Do not change anything for 90 days. This is the “First 90 Days” Doctrine. Your only job in the first quarter is to stabilize the patient. No new software. No firings. No “visionary” speeches. Just listen. If you try to fix what isn’t broken, you will break the culture.

6. DEAL STRUCTURE > PRICE (THE ULTIMATE LEVERAGE)

This is the most critical point for your wealth. The Price is vanity. The Terms are sanity.

Amateurs negotiate the price (“I want to pay $900k instead of $1M”). Pros negotiate the structure (“I will pay $1M, but only $400k down”).

Seller Financing as Truth Serum (With Caveats): You should almost always demand Seller Financing (Seller Note). This means the seller acts as the bank for a portion of the price (e.g., 20-30%).

- Why this matters: It is not just about saving cash. It is about Alignment of Incentives.

If a seller says: “I want $1M, all cash, upfront,” they are telling you: “I do not trust this business to survive without me, so I want to take all the chips off the table now.” If a seller says: “I will carry 30% of the note over 5 years,” they are telling you: “I know this business will generate enough cash to pay me back.”

Caveat: Seller financing isn’t magic. You still need covenants (rules the seller must follow) and subordination agreements if a bank is involved. But it is one of the strongest signals of confidence a seller can give.

The “Clawback” Clause: In your purchase agreement, you need specific Indemnification Clauses. If you buy the business and 3 months later you get sued for a product defect from 2 years ago, who pays? If you don’t structure this legally, you pay. If you have a Seller Note, you can simply Offset the cost. You stop paying the seller until the legal fee is covered. This is your insurance policy.

MARKET PATTERNS & DATA ANCHORS

- The “Silver Tsunami”: Data from the Exit Planning Institute (2023 State of Owner Readiness Report) suggests that trillions in business value are set to transition as Baby Boomers retire. This creates a supply-rich environment for buyers.

- The Default Reality: Across SBA performance datasets, change-of-ownership loans tend to outperform true startup loans because you are underwriting existing cash flow, not a business plan. This validates the thesis that buying cash flow carries lower risk than building it from zero—IF due diligence is performed.

- Valuation Multiples: Per BizBuySell Insight Reports (2023-2024), the average multiple for small businesses sold typically hovers in the 2.0x – 3.0x SDE range. If a seller is asking for 5x SDE for a standard service business (non-SaaS), they are likely overpriced relative to the market.

THE BYB CONCLUSION: OPERATOR OR INVESTOR?

Before you proceed, you must look in the mirror.

Are you buying a business to operate it, or to invest in it?

- The Operator (SBA Buyer): You will be the CEO. You will answer the phone when the toilet breaks. You will handle the payroll crisis. This is a job, but a high-paying one if you succeed.

- The Investor (Search Fund/Private Equity): You want to hire a GM to run it.

The Warning: If you buy a business with less than $300k in SDE, you generally cannot afford to be an Investor. A competent General Manager commands a significant salary (often $100k+). If the business makes $200k, and you hire a GM, you are left with minimal profit. After debt service (loan payments), you are likely cash flow negative.

To be a “Passive Owner,” you typically need to buy a business with $500k+ SDE to support the management layer. Anything smaller requires your sweat equity.

Buying a business can be one of the fastest paths to wealth, but also the fastest path to a personal hell. The difference is not luck. The difference is Due Diligence.

Audit the financials. Interview the culture. Structure the deal. Don’t buy a job. Buy a machine.

Leave a Reply