You’re searching for how to get rich because your salary just taught you the system’s cruelest lesson: effort doesn’t equal wealth.

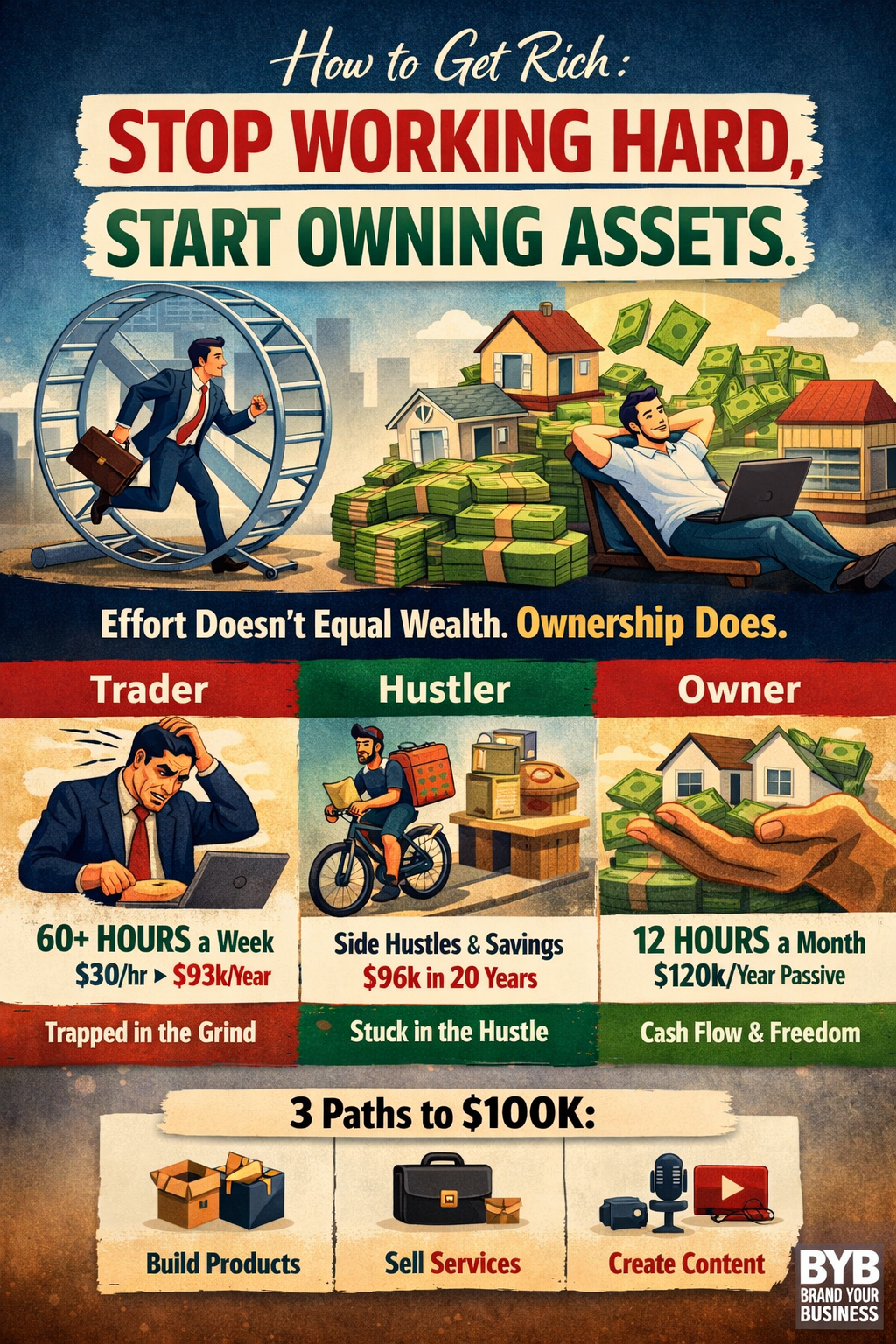

Someone working 60-hour weeks at $30/hour makes $93,600 a year before taxes. Someone who owns four rental units works 12 hours a month and clears $120,000 annually. The difference isn’t intelligence, hustle, or luck. It’s ownership. One person trades hours for dollars. The other collects cash flow from assets. If your income stops the moment you stop working, you’re not building wealth—you’re just well-compensated labor on an expensive treadmill.

This article defines “rich” explicitly: net worth of $100,000 or more. Not income. Not salary. Actual assets minus liabilities.

Why $100,000? Because it’s the minimum threshold where money starts working harder than you do. Below $100k, you’re still manually grinding. At $100k deployed into cash-flowing assets at a conservative 8% annual return, you’re generating $8,000/year passively—enough to cover 2-3 months of basic living expenses without lifting a finger. That’s the structural difference between “still trapped” and “starting to break free.” Everything below that benchmark is financial fragility dressed up with better furniture.

Why You’ll Never Get Rich (The Real Diagnosis)

Most people stay broke not because they don’t work hard, but because they don’t own anything. The system is designed to keep you productive, not wealthy. Here’s how it traps you:

The Saving Delusion

You’ve been told to save 10% of your income. If you earn $4,000/month and save $400, you’re putting away $4,800 annually. Over 20 years, that’s $96,000 before inflation.

According to historical inflation data from the U.S. Bureau of Labor Statistics, a 3% average annual inflation rate cuts purchasing power in half every 24 years. Your $96,000 will spend like $59,000 in two decades. You didn’t build wealth. You built a slightly larger emergency fund while your real purchasing power eroded.

Income stops when you stop. Saving preserves what you already have. It doesn’t create assets that generate independent cash flow.

The Side Hustle Trap

The advice sounds productive: keep your job and start a side hustle for extra income. In reality, you just gave yourself two jobs instead of one asset.

If you’re delivering food after work, doing freelance gigs on weekends, or selling products that require constant fulfillment, you’re trading more hours for more money. The second your physical presence stops, income stops. That’s not wealth. That’s exhaustion marketed as entrepreneurship.

You’re not broke because you don’t work hard—you’re broke because you don’t own anything.

The Index Fund Illusion

Index funds are treated as the default path to wealth. Historical S&P 500 data shows an average annual return of roughly 10% over the long term. If you invest $500/month starting at age 25, you’ll accumulate approximately $380,000 by age 55.

That’s 30 years of discipline for a sum that might cover 8-10 years of retirement expenses if healthcare costs don’t demolish you first. Index funds work for wealth preservation once you already have capital. They don’t work for wealth creation from a median salary.

Income stops when you stop. Passive index investing is slow compounding for people who already have $50,000+ to deploy. If you’re starting with $3,000, it won’t make you rich by 35. It’ll make you comfortable by 65—maybe.

How to Get Rich: The Ownership Mechanism

Rich people don’t work harder than you. They own systems that generate revenue without their constant physical involvement.

An asset is anything that deposits money into your account while you’re not actively working:

- A rental property generating monthly cash flow

- A business with employees running operations

- An e-commerce store processing orders on autopilot

- Digital products (courses, software, templates) selling repeatedly

- Content generating ad revenue or affiliate commissions years after creation

- Vending machines, laundromats, car washes running with minimal oversight

The fundamental divide is simple:

Employee mindset: Hours traded for dollars (ceiling: 168 hours/week)

Owner mindset: Assets generating income independently (ceiling: unlimited scale)

A franchise owner with three locations doesn’t cook at all three simultaneously. Staff operate. Systems run. The owner collects profit. A software developer who built a SaaS tool in 2022 still earns $12,000/month in 2026 from subscribers paying for access. A landlord with six units doesn’t live in six places. Tenants pay monthly. The landlord manages quarterly.

You’re not broke because you don’t work hard—you’re broke because you don’t own anything.

This is the only sustainable mechanism for building wealth: acquire or create assets that compound without hourly input.

Three Paths to $100,000 (Pick One or Stay Broke)

You have three realistic paths. Don’t try all three. Pick the one that matches your current capital and skills, then execute with obsessive focus.

Path 1: Build and Sell Products

Launch an e-commerce business selling physical or digital goods. This path is for people who can handle delayed gratification and financial uncertainty for 6-12 months while testing what actually sells.

Capital required: $500-$2,000 (inventory, platform fees, initial ads)

Time investment: 15-20 hours/week initially

Income timeline: $10k-$30k revenue in Year 1, $50k-$100k+ in Year 2-3 with optimization

How it works:

You source products (dropship, wholesale, or create), list them on platforms (Shopify, Amazon, Etsy), drive traffic through ads or SEO, and fulfill orders. The goal is building a system where orders process without you manually handling every transaction.

The brutal filter:

Most product businesses fail in the first 18 months not because the model is broken, but because founders chase shiny trends instead of solving real problems. If you’re picking products based on what’s “hot” on TikTok instead of what people actively search for and need, you’re gambling on virality. Gambling loses. If you can’t stomach losing $1,500 testing products that don’t sell before finding one that does, this path will break you. Comfort-seekers should stay employees.

For a breakdown of when to build versus buy existing cash-flowing systems, see how to build passive income.

Path 2: Sell High-Value Services

Package a skill into a repeatable service business that eventually runs without you. This path is for people who already have a marketable skill or can acquire one in 90 days without whining about how hard learning is.

Capital required: $0-$500 (just tools and internet)

Time investment: 20-30 hours/week to start

Income timeline: $20k-$40k in Year 1, $60k-$100k+ in Year 2-3 as you hire and scale

How it works:

You sell expertise (design, writing, consulting, video production, web development) initially trading your time, then systematize delivery and hire others to execute. You transition from doer to manager to owner.

The ego destroyer:

Most service businesses stay trapped as glorified freelancing because founders are addicted to being needed. They can’t let go. They micromanage every project because “no one can do it like I do.” If you’re still the one doing every project in Year 3, you didn’t build a business—you built a prison where you’re both the warden and the inmate. Income stops when you stop. Your inability to delegate isn’t perfectionism. It’s ego. Fix it or die broke with a portfolio you’re proud of.

Path 3: Build Content, Monetize Attention

Create content that attracts an audience, then convert attention into revenue through ads, sponsorships, or affiliate commissions. This is the slowest path with the highest quit rate, which is exactly why it works for the 5% who don’t quit.

Capital required: $0-$300 (equipment if doing video)

Time investment: 10-15 hours/week consistently

Income timeline: $5k-$15k in Year 1, $30k-$100k+ in Year 2-4 with audience growth

How it works:

You produce valuable content (YouTube, blog, podcast, newsletter), build an engaged audience, and monetize through platform ads, brand partnerships, or affiliate offers. Old content continues generating revenue years after publication.

The patience test:

90% of content creators quit before Month 6 because they expect instant results and validation. They post 12 videos, get 47 views total, and convince themselves “the algorithm hates me” or “the platform is saturated.” The platform isn’t the problem. Your inability to produce consistently without immediate dopamine hits is the problem. Content compounds slowly, then explosively. If you’re not willing to create for 18 months with $0-$500/month returns while your friends mock you for “wasting time,” this path will destroy your ego before it pays you. Instant gratification addicts need not apply.

You’re not broke because you don’t work hard—you’re broke because you don’t own anything. All three paths require converting labor into assets that operate independently. Pick one based on your capital and temperament, then execute without excuses or pivoting every 90 days when results aren’t instant.

Why Most People Fail (The Fatal Mistakes)

Even when people start building assets, three structural failures destroy progress:

Failure 1: Lifestyle Inflation

You start earning $6,000/month instead of $3,500. Immediately, you upgrade your apartment, lease a better car, add premium subscriptions. Your expenses rise from $2,800 to $5,400. You’re making 70% more and somehow still living paycheck to paycheck—just with nicer things.

Wealth is built by keeping expenses flat while income explodes. If your burn rate rises with earnings, you’re not accumulating capital. You’re funding a more expensive lifestyle that traps you in the labor cycle permanently.

Failure 2: Fragmented Focus

You try e-commerce, freelance consulting, YouTube, and crypto trading simultaneously. Six months later, you have four mediocre experiments generating $400/month combined instead of one profitable system generating $4,000/month.

Concentration creates wealth. Diversification preserves it. When you’re building from zero, you need asymmetric returns—10x or higher. That requires obsessive focus on one vehicle until it breaks through, not shallow dabbling across ten.

Failure 3: Building Non-Sellable Systems

You launch a consulting practice. You’re the only consultant. Every client wants you specifically. If you take two weeks off, revenue stops. If you get sick, the business collapses. You didn’t build an asset—you built a high-paying job with no exit strategy and no enterprise value.

Income stops when you stop. Real wealth comes from systems that operate without your daily involvement. If your business can’t survive 60 days without you, it’s worthless to anyone except you. No buyer will pay a multiple for a business that dies when the founder leaves.

If you’re considering acquiring an existing business instead of building from scratch, read buying a business due diligence traps before signing anything.

How to Get Rich from Nothing (The Zero-Capital Reality)

If you have no money, you don’t have options. You have one path: sell what’s already in your head.

Stop waiting for startup capital. Stop looking for investors. Stop fantasizing about the “perfect business idea.” You’re broke because you’re stalling. Services are the only vehicle that converts zero dollars into cash flow within 30 days.

Here’s what separates people who escape broke from people who romanticize it:

You acquire a skill the market pays for. Not what you’re passionate about. Not what sounds fun. What the market will pay $300-$1,000 for repeatedly. Copywriting. Video editing. Web design. Social media management. Basic development. Consulting in something you already know. Pick one. Learn it in 90 days. If you can’t commit to 90 days of focused skill acquisition, you’re not serious about being rich—you’re serious about complaining about being broke.

You get paid this week, not next quarter. Cold outreach on LinkedIn. Post your offer on Upwork. Join Facebook groups where your buyers congregate. Offer to solve one specific problem for $300. No portfolio needed. No years of experience required. Just results. Deliver exceptional work. Get a testimonial. Do it again. If you can’t close one client in 30 days, your offer is weak or your outreach is lazy. Fix it or accept you’re not built for this.

You systematize so it doesn’t die when you sleep. Create templates. Document processes. Build workflows that someone else can execute. The second you can teach another person to deliver your service at 80% of your quality, you’ve converted labor into a system. Hire someone cheaper than you. Manage quality. Collect margin. If you’re still doing every project yourself in Month 9, you didn’t build a business—you built a job with no boss and no benefits.

You scale by reinvesting profit, not spending it. Every dollar you make goes into hiring, tools, or ads—not a better apartment or a car lease. Lifestyle inflation is a disease that keeps the ambitious poor. If you’re making $6,000/month and spending $5,400, you’re a high-earning broke person. Wealth is built by people who make $6,000 and spend $2,800 while the gap compounds into assets.

This path takes you from $0 to $50,000-$100,000 in net worth within 18-30 months if you execute without distraction or excuses. You’re not broke because you don’t work hard—you’re broke because you don’t own anything. Services are the fastest way to stop being broke, but only if you’re willing to endure the discomfort of cold rejection, systemization, and delayed gratification.

Most people quit at Month 4 because it’s hard and the results aren’t instant. That’s why most people stay broke.

The Decision (Final Confrontation)

In five years, you will either own assets or still trade hours for dollars.

Most people tell themselves they’ll start next year. Next year becomes five years. Five years becomes never. The gap between financial fragility and $100,000 in net worth isn’t closed by working harder at your job. It’s closed by owning systems that compound.

You can work 70-hour weeks for two decades and still end up one layoff away from bankruptcy if you’re positioned wrong. Effort without ownership is just expensive labor. The market doesn’t reward how hard you worked. It rewards what you own.

Income stops when you stop. That’s the reality for 93% of people. They have jobs, not assets. Salaries, not equity. Paychecks, not cash flow.

You have two paths:

- Build or buy something that generates income without your constant presence

- Keep working until your body or the economy decides you can’t

There’s no third option. No middle ground. No “I’ll figure it out later.”

The math is binary. The decision is structural.

Build something that works without you, or work until you can’t. That’s the only choice.

Leave a Reply