You have been fed a comforting lie about the Wealth Pyramid.

Society, the media, and your own ego have convinced you that the pyramid is a ladder of income. You believe that moving from a $50,000 salary to a $250,000 salary means you have climbed the pyramid. You believe that a “Vice President” title or a corner office is proof that you are winning.

You are mistaken.

If you earn $250,000 a year but your lifestyle costs $250,000 a year to maintain, you have not moved an inch. You have simply upgraded the decoration of your cell. You are not wealthy; you are a high-performance engine running on fumes.

Real wealth is not defined by the number on your paycheck. It is defined by the separation of your time from your income.

Most people do not have a money problem. They have a level problem.

To understand where you actually stand, we must first dismantle the definition you were taught, expose why it was created, and replace it with the cold truth of how the game is actually played.

What Is the Traditional Wealth Pyramid?

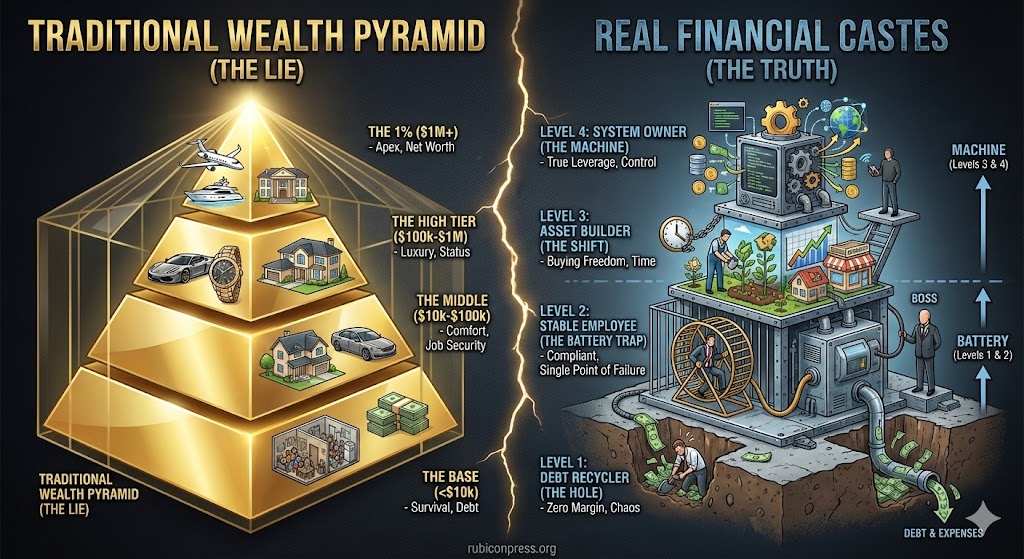

Before we destroy the illusion, we must understand the standard model. If you search for “Wealth Pyramid” on Google, you will see charts derived from global banking reports like those from UBS or Credit Suisse.

This traditional model categorizes the global population strictly by net worth—what you own minus what you owe.

The Standard Tier Structure:

- The Base: Adults with less than $10,000.

- The Middle: Wealth between $10,000 and $100,000.

- The High Tier: Wealth between $100,000 and $1 Million.

- The Apex (The 1%): Wealth over $1 Million.

Why This Model Is a Trap

Banks use this model to find customers. It answers one question for them: “Who can pay our fees?”

It is accurate for a bank. It is useless for you.

Why? Because it measures the result, not the method. It tells you where people are, but it hides how they are trapped. It allows a high-income doctor with $500,000 in debt to feel “richer” than a modest business owner with $50,000 in the bank and zero debt. The doctor is technically higher on the pyramid, but the business owner is free. The doctor is owned by the bank.

The bank’s pyramid measures amount. The real pyramid measures control.

The gap between the bottom and the top is not just a gap in money; it is a gap in logic. The bottom trades time for survival. The top trades risk for freedom.

The Core Metaphor: The Battery vs. The Machine

To navigate the real Wealth Pyramid, you must understand the two fundamental roles in the economy. Every single person reading this falls into one of these two categories.

1. The battery (Levels 1 & 2)

A battery stores energy. It is useful only when it is draining that energy. If you are a battery, you are paid for your charge—your time, skill, and effort.

- When you stop working, the energy stops.

- When the energy stops, the value stops.

- When the value stops, you are replaced.

The economy does not repair dead batteries; it swaps them. It does not matter if you are a cheap AA battery (low wage) or an expensive industrial battery (CEO). If the power cuts when you unplug, you are a battery.

2. The machine (Levels 3 & 4)

A machine creates value. It requires oil and oversight, but its output is not tied to the owner’s sweat.

- The machine works while the owner sleeps.

- The machine grows without the owner’s physical presence.

- The machine is an asset that can be sold.

The transition from battery to machine is the only metric that matters. Everything else is noise.

Who This Analysis Is For

This framework is not for everyone. If you are struggling with poverty, your focus is immediate survival, not strategy. This analysis is specifically designed for:

- The High-Income Professional: You earn well but feel broke at the end of the month.

- The Corporate Climber: You are chasing titles hoping they lead to freedom (they won’t).

- The Stuck Founder: You built a “business” that collapses the moment you take a vacation.

If that is you, pay attention. These are the 4 Financial Castes where you actually live.

Level 1: The Debt Recycler

This is the bottom.

Do not mistake this for “low income.” You can earn six figures and still live here. According to industry reports from Pymnts, nearly one-third of earners making over $150,000 live paycheck to paycheck.

This level is defined by having zero margin. Money enters your life and immediately exits to pay for past decisions.

The Hole

The formula here is simple and terrifying: Income equals expenses plus debt.

You are digging a hole to fill a hole. You use a credit card to buy groceries, hoping the next paycheck covers the bill. You are essentially borrowing time from your future self to pay for your present existence.

The Real Risk

At Level 1, you are not “unlucky.” You are disorganized. A broken transmission or a delayed client payment is not an inconvenience. It is a crisis. Because you have no buffer, every minor problem compounds.

- You pay late fees.

- You pay overdraft fees.

- You pay high interest.

Being poor at Level 1 is expensive. The system punishes you for having no margin, debt is not neutral. It is structural dependency.

The Fix: You do not need stock tips. You need a tourniquet. You must stop the bleeding before you can think about growth.

Level 2: The Stable Employee (The Trap)

This is where the majority of the educated workforce gets stuck. This is the “Middle Class” of the traditional pyramid, but in the real pyramid, it is a golden cage.

You have paid off the toxic debt. You have a mortgage. You have a savings account. Relative to Level 1, you feel safe.

You are not safe. You are obedient.

One Boss

Your entire financial existence relies on one variable: Your employer. You trade time for money. That is your only leverage.

- If you stop working, the revenue stops.

- If the market shifts, the revenue stops.

- If AI replaces your department, the revenue stops.

The Lifestyle Trap

This is why Level 2 is the hardest to leave. As your income rises, your “needs” mysteriously rise to match it. This is lifestyle creep.

You get a $20,000 raise. Suddenly, the Toyota isn’t good enough; you need the BMW. The apartment isn’t big enough; you need the house. The local school isn’t prestigious enough; you need private education.

You have built a high-overhead life that requires a constant, high-pressure injection of cash. You cannot quit your job because your lifestyle holds you hostage. You are a high-performance battery that is terrified of running out of charge. You think you own your things, but your things own you.

Level 3: The Asset Builder (The Shift)

This is the filter. This is where you cross the line from “consumer” to “owner.”

At Level 3, you stop buying things and start buying freedom. You do not ask, “What can I buy?” You ask, “What can I own?”

The Boring Reality

Moving to Level 3 is painful for your ego. While your Level 2 peers are upgrading their cars to signal success, the Level 3 operator keeps their expenses low to buy income.

You buy index funds. You buy rental units. You buy equity in boring businesses. You look “cheap” to the outside world. Your friends might even pity you. But you are buying the only thing that matters: time.

The Crossover

The goal of Level 3 is to reach the point where the income from your assets exceeds your basic survival expenses. Once you hit this point, your labor is no longer about survival. It is about growth. You are still working, but the desperation is gone. You have built a runway. You can say “no” to a bad boss because your assets pay for your groceries.

Level 4: The System Owner (The Apex)

This is the top of the real Wealth Pyramid.

Level 3 owns shares. Level 4 owns the engine.

You do not chase money. You build systems that catch it.

True Leverage

At this level, income is disconnected from personal effort. You use the three tools that Level 1 and 2 ignore:

- Other People’s Money: You fund growth without draining your savings.

- Other People’s Time: You hire teams to execute the vision.

- Code & Media: You build software or content that works 24/7.

The Reality Check

Do not confuse Level 4 with “doing nothing.” Level 4 is not a permanent vacation. Systems break. Employees quit. Markets change. Competitors attack. The difference is the type of work.

- Level 2 works on the task.

- Level 4 works on the system.

If you must be physically present for the business to make money, you do not own a system. You own a job with overhead. You are still a battery—just a battery that pays its own rent.

How to Move Up: The Blueprint

You cannot jump from Level 1 to Level 4. You must climb the steps. The economy punishes those who try to skip levels. Here is what you actually need to do.

To Escape Level 1

Your only goal is to stop the bleeding. Cut all non-essential spending. Sell the car you can’t afford. Downgrade your apartment if you have to. Build a one-month cash buffer. Until you have this, you are in crisis mode. Do not think about investing. Do not think about side hustles. Fix the hole in your pocket.

To Escape Level 2

You must break the link between income and spending. Freeze your lifestyle. If you get a raise, invest 100% of the difference. Do not upgrade your house. Do not upgrade your car. Build six months of liquidity. This cash is not for spending. It is for courage. It gives you the ability to take the risks needed to reach Level 3.

To Escape Level 3

Use your cash to buy income.

Not every side hustle creates leverage. Many are just second jobs disguised as freedom, why most side hustles keep you poor?

Stop just buying generic stocks and start building specific cash-flow engines. Look at real estate, side businesses, or digital products. The target is simple: your asset income must be higher than your monthly burn rate. This is independence. This is where you stop being a battery.

The Final Decision

Stop looking at the UBS charts. Look at your own burn rate.

The economy does not care about your potential. It cares about your position. You have a binary choice to make today.

Option A: Continue to pretend. Keep playing the status game. Keep upgrading your lifestyle to match your income. Keep relying on a single employer for your survival. Hope that the economy never turns, and your health never fails.

Option B: Start the climb. Accept that you will look “boring” for a few years. Freeze your spending. Redirect every cent of surplus into assets. Build a system that operates without your labor.

This is not a motivational speech. It is a survival instruction. If the money stops when you stop, you are not free.

Wealth Pyramid FAQ

What is the Wealth Pyramid really measuring?

It measures net worth. That’s it. It tells you how much you own minus how much you owe. It does not measure freedom. It does not measure control. It does not measure whether you can stop working tomorrow.

Is income the same as wealth?

No. Income stops when you stop working. Wealth continues when you don’t. If your money depends on your presence, you have income. If it survives without you, you have wealth.

Why do high-income earners still live paycheck to paycheck?

Because spending rises with income. Bigger salary, bigger house. Bigger house, bigger stress. If expenses grow at the same speed as income, nothing changes.

What is the real goal of climbing the Wealth Pyramid?

To reach the point where your asset income covers your living costs. After that, work becomes optional. Before that, it’s survival.

Is net worth the same as financial freedom?

No. You can have a high net worth and still be trapped by debt, overhead, or lifestyle. Freedom is not about the number. It’s about dependency.

What separates Level 2 from Level 3?

Level 2 depends on a paycheck. Level 3 owns income-producing assets. That’s the line.

Leave a Reply