THE PROFIT TRAP: WHY SOLVENCY MATTERS MORE THAN MARGIN

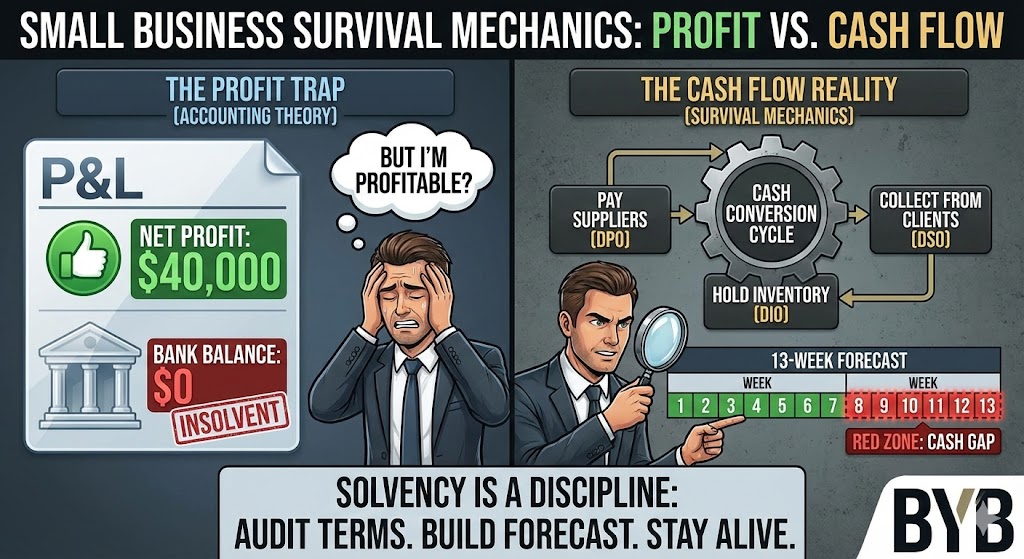

One of the most common causes of small business failure is a fundamental misunderstanding of the difference between profit and cash. The misconception is simple but fatal: “If I am profitable on paper, I am safe.”

This is a financial hallucination. You can be “profitable” on your P&L statement and insolvent in your bank account on the same day.

- The Scenario: You land a $100,000 contract. You spend $60,000 on materials and labor to deliver it. Your accountant says you made $40,000 in profit.

- The Reality: The client pays you in 60 days. Your staff and suppliers need to be paid today. You have a $60,000 hole in your bank account. You cannot make payroll. You are insolvent.

Effective cash flow management for small business is not just accounting theory; it is survival mechanics. Multiple SME banking and advisory reports consistently indicate that poor cash flow management—not a lack of customers—is a primary driver of small business insolvency.

If you run your business solely based on your P&L, you are operating with a blindfold. This article is a forensic guide to moving beyond basic budgeting to the mechanics of liquidity.

WHAT IS CASH FLOW MANAGEMENT FOR SMALL BUSINESS?

Before fixing the problem, we must define the mechanism.

Cash flow management for small business is the process of tracking, analyzing, and optimizing the net amount of cash receipts minus cash expenses. Unlike “profit,” which is an accounting calculation of value, “cash flow” is the literal movement of liquidity.

It is a core component of broader small business financial management discipline, not a standalone accounting task.

- Positive Cash Flow: More money is entering the bank account than leaving it within a specific period.

- Negative Cash Flow: More money is leaving than entering.

The Core Objective: The goal is not just to be cash positive, but to accelerate the velocity of cash. You want to shorten the time between spending a dollar (on inventory or labor) and getting that dollar back (from the customer) with a profit attached.

WHY PROFIT DOES NOT EQUAL CASH

To master cash flow, you must understand the “Valley of Death” gap.

The Income Statement (P&L) records revenue when it is earned (invoiced), not when it is received. The Cash Flow Statement records revenue only when it hits the bank.

The “Growth” Paradox: If you grow too fast, your expenses (hiring, inventory, software seats) often accelerate faster than your collections.

- Result: You “grow broke.” You double your revenue, but because your cash is tied up in Accounts Receivable and Inventory, your bank balance hits zero.

Unless you have a system to bridge this gap, profit is a vanity metric. You cannot pay rent with “Retained Earnings.” You can only pay rent with cash.

THE MECHANICS: UNDERSTANDING THE CASH CONVERSION CYCLE (CCC)

Most business owners do not know their CCC. This is a critical oversight. The Cash Conversion Cycle measures the time lag between cash leaving your pocket (to pay suppliers/staff) and cash entering your pocket (from customers).

The Formula: CCC = DIO + DSO – DPO

- DIO (Days Inventory Outstanding): How long cash sits “dead” on your shelf as stock.

- DSO (Days Sales Outstanding): How long it takes customers to pay you.

- DPO (Days Payable Outstanding): How long you take to pay your suppliers.

The Forensic Audit:

- If your DIO is 30 days (stock sits for a month)…

- And your DSO is 45 days (clients are slow to pay)…

- And your DPO is 15 days (suppliers demand quick payment)…

- Your CCC is 60 Days.

The Implication: For 60 days, you are financing the entire operation out of your own pocket. You are essentially lending money to your clients interest-free while paying your suppliers early. Strategy: Drive your CCC to zero (or negative). Companies like Amazon often operate with a negative CCC (they get paid by the customer before they pay the supplier).

STRATEGY 1: OPTIMIZING ACCOUNTS RECEIVABLE (GET PAID FASTER)

Your Accounts Receivable (AR) is not an asset in the practical sense until it collects. Until then, it is an unsecured loan you have issued to your client. To improve cash flow management for small business, you must tighten your terms.

1. The “Upfront” Mandate For service businesses, shift to a deposit model. Require 50% upfront and 50% on completion. This covers your hard costs immediately and validates the client’s liquidity.

2. The “Net 15” Pivot Why do you offer “Net 30” terms? Often, it is just habit. Change your default invoices to Net 15 or “Due on Receipt.”

- Note: If a client demands Net 45 or Net 60, treat that as a negotiated privilege. Consider charging a premium (e.g., 2-5%) for extended financing.

3. Automated Collections Do not rely on memory to chase invoices. Implement automated dunning sequences via your accounting software (Xero/QuickBooks/FreshBooks):

- Reminder 1: 3 days before due.

- Reminder 2: On due date.

- Reminder 3: 3 days overdue (with a firmer tone).

STRATEGY 2: OPTIMIZING ACCOUNTS PAYABLE (PAY SMARTER)

While you want to reduce your DSO (get paid fast), you want to extend your DPO (pay slow)—without damaging your credit or relationships.

1. Negotiate Terms, Not Just Price Everyone tries to negotiate the price down. Smart operators negotiate the terms up.

- Script: “I can’t do the higher volume order unless we move from Net 15 to Net 45. This allows me to sell through the inventory before I pay you.”

2. The Credit Card Float If a vendor accepts credit cards without a fee, utilize a business card with a 30-day cycle.

- The Math: You buy on Day 1. You pay the card issuer on Day 30. You have effectively created a 30-day interest-free loan to bridge your cash gap.

3. The “Due Date” Discipline Do not pay late, but do not pay early. Paying an invoice 15 days early is effectively giving your supplier a donation of liquidity. Schedule payments to land exactly on the due date.

STRATEGY 3: BUILDING A 13-WEEK CASH FLOW FORECAST

Your accounting software tells you history. You need a tool for prophecy. The 13-Week Cash Flow Forecast is the industry standard for turnarounds and CFOs.

In distressed scenarios, this becomes the backbone of any financial turnaround strategy for small business.

Why 13 Weeks? It covers one fiscal quarter. It is short enough to be accurate (rent and payroll are predictable) but long enough to spot a crisis before it becomes fatal.

How to Build It (The Direct Method): Do not use accrual accounting. Use cash movements.

- Columns: Week 1 through Week 13.

- Row 1 (Cash In): List specific invoices expected to clear (not “sales projections,” but actual collections).

- Row 2 (Cash Out): List specific rent, payroll runs, tax payments, and supplier bills.

- Row 3 (Net Change): (Cash In – Cash Out).

- Row 4 (Ending Balance): Does it ever dip below zero?

The “Red Zone” Analysis: If Week 8 shows a projected balance of -$5,000, you have 8 weeks to fix it.

- Push a supplier payment to Week 9.

- Pull a client payment to Week 7 (offer a small discount for early pay).

- Draw on a line of credit. Without the forecast, you hit the wall at Week 8. With the forecast, you maneuver around it.

STRATEGY 4: INVENTORY & TAX SEGREGATION

The Inventory Trap Inventory is cash that is currently useless for paying bills. It is not just an asset; it is a liability that costs money to hold.

- Holding Costs: Industry estimates suggest the annual cost of holding inventory (storage, insurance, shrinkage, obsolescence) ranges between 20% to 30% of the inventory’s value, depending on industry vertical and supply chain complexity.

- The Audit: Calculate your Inventory Turnover Ratio. If it is low, aggressively discount “dead stock” to convert it back into liquidity.

The Tax Segregation Protocol Small business owners often look at their bank balance and think, “I have $50,000.” Included in that amount is likely Sales Tax (VAT) and Payroll Tax.

- Rule: Open a separate savings account labeled “Tax Hold.”

- Action: Every time a payment comes in, immediately transfer the tax percentage to that account.

- Legal Warning: Using payroll tax funds for operations is dangerous. In many jurisdictions, this can constitute a serious legal violation or personal liability. Treat these funds as untouchable.

EDGE CASES: WHEN YOU CANNOT CONTROL TERMS

Sometimes, you are the small fish. A massive corporate client (e.g., Walmart, Government) may demand Net 60 or Net 90 terms and refuse to negotiate. In this scenario, you cannot “force” a Net 15. You must engineer around it.

1. Price the Capital: If a client demands Net 60, calculate the cost of floating that cash. Increase your pricing by 3–5% to cover the “cost of capital.”

- The Math: If you wait 60 days for payment, that capital is dead for 1/6th of the year. A 3% surcharge effectively recovers an annualized interest rate of roughly 18% on that frozen capital.

2. Invoice Factoring: Use a factoring service to sell the invoice immediately for 97% of its value. You lose 3% margin, but you gain 100% liquidity today.

3. Dynamic Discounting: Offer a tiered discount on the invoice face itself: “2% discount if paid in 10 days, Net 60 otherwise.” Corporate treasury departments often have mandates to capture these discounts, bypassing the standard payment delays.

QUICK IMPLEMENTATION CHECKLIST

If you are currently in a cash crunch, execute this Cash Flow Triage Protocol immediately:

- [ ] Audit Invoices: Identify all invoices 30+ days overdue. Call them today. Not email—call.

- [ ] Stop the Bleeding: Halt all non-essential discretionary spending (software subscriptions, office perks) for 30 days.

- [ ] Switch Terms: Change all outgoing new invoices to “Due on Receipt” or Net 15.

- [ ] Build the Forecast: Create a simple spreadsheet for the next 13 weeks of cash movements. Identify the lowest point.

- [ ] Tax Segregation: Open a separate bank account today and move all accrued tax liabilities into it.

CONCLUSION: SOLVENCY IS A DISCIPLINE

Stop celebrating the “closed deal.” Celebrate the “cleared check.”

The businesses that survive volatile markets are not necessarily the ones with the highest profit margins; they are the ones with the strictest cash flow management.

- Profit is a theory.

- Revenue is a vanity metric.

- Cash flow is a fact.

If you cannot pay the bills on Friday, your vision for Monday is irrelevant. Audit your terms, build your forecast, and respect the mechanics of your cash conversion cycle.

Solvency is not a passive state. Build the forecast today—or accept that you are operating blind.

Leave a Reply